Oct 6, 2017 | News

“Writing in The Hill, Alex Brill of the conservative American Enterprise Institute estimated that repealing the deduction could help subsidize major parts of the tax plan, including the proposed tax cut for top filers and the expansion of the standard deduction. As Brill wrote, that could mean a cap on how much of a filer’s income could be eligible for the deduction.”

Oct 6, 2017 | Op-Eds

On a bipartisan and bicameral basis, lawmakers have proposed legislation to allow (not require) states to collect sales tax on goods purchased from out-of-state sellers. The legislation is not a new tax but rather facilitates the collection of taxes already due.

Oct 5, 2017 | News

On the other hand, the SALT deduction incentivizes higher state and local spending and doesn’t have the great distributional implications, as my colleague Alex Brill carefully explains here. I could probably go either way on this one.

Oct 5, 2017 | Op-Eds

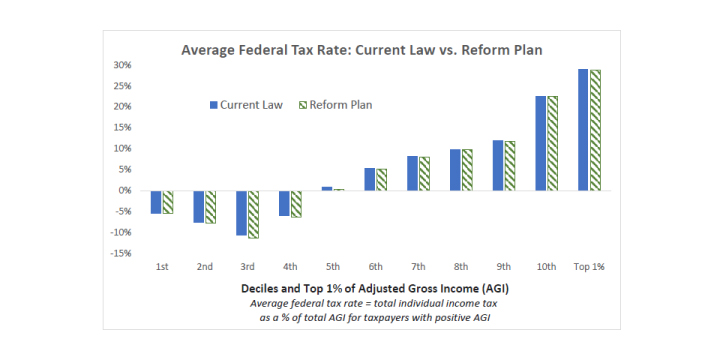

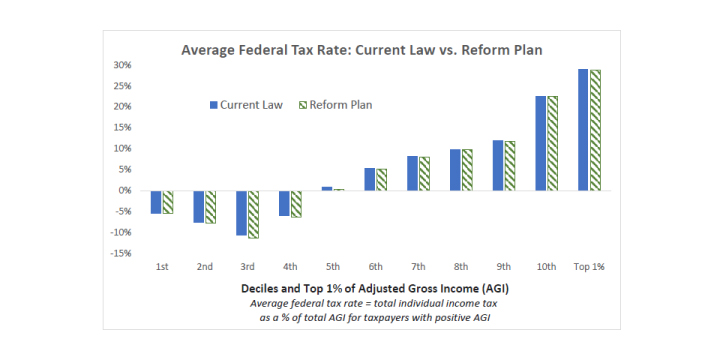

The SALT deduction is the largest itemized deduction and one of the largest tax expenditures in the entire tax code. I estimate that its repeal would raise $1.4 trillion in new revenue over a decade. In the piece for The Hill, I calculated how to “recycle” that $1.4 trillion in a distributionally neutral manner by lowering tax rates and increasing the standard deduction.

Oct 3, 2017 | Op-Eds

The latest Republican tax reform framework promises to lower statutory rates and repeal scores of tax preferences. The centerpiece of the reform of the individual income tax is the repeal of the largest itemized deduction, which is for for state and local taxes. Repealing this deduction alone can finance a cut in the top tax rate to 35 percent and a reduction in other rates, preserve the tax code’s progressivity, substantially increase the number of taxpayers on the standard deduction, and cut taxes for half of all filers.