Feb 27, 2019 | Events

On February 27, a panel of addiction experts and community leaders joined Rep. Greg Walden (R-OR) to discuss the nation’s ongoing efforts to curb opioid misuse and addiction.

Sep 8, 2018 | Events

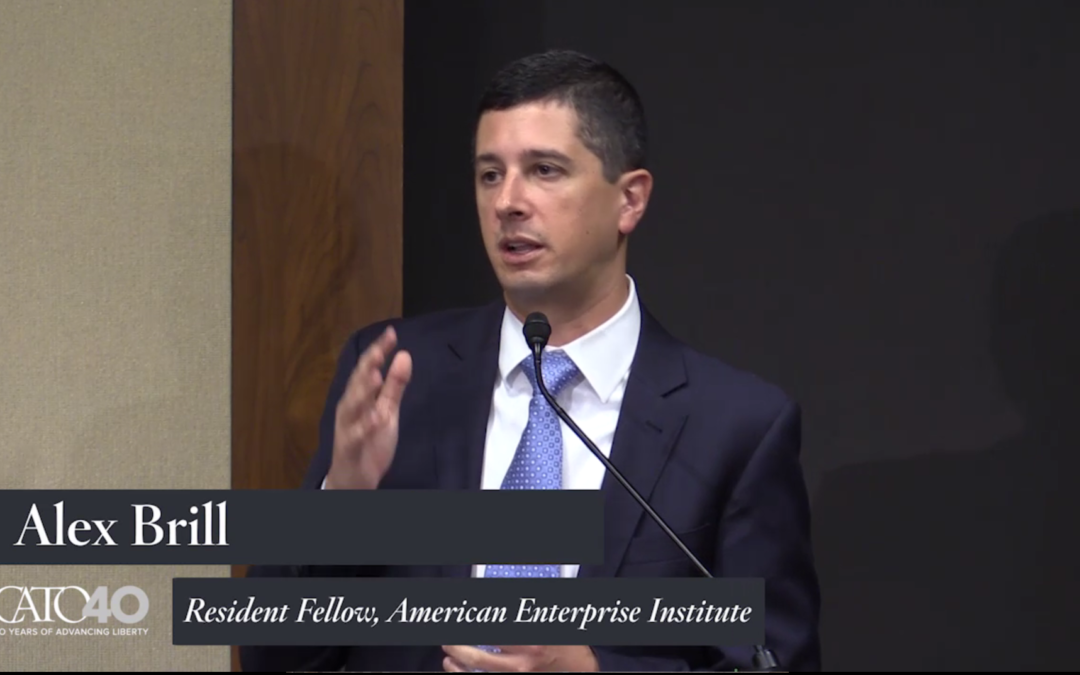

As Brill sees it, there are 4 main categories of barriers to biosimilar uptake: reference product manufacturers, biosimilar manufacturers, policy, and education.

Mar 9, 2018 | Events

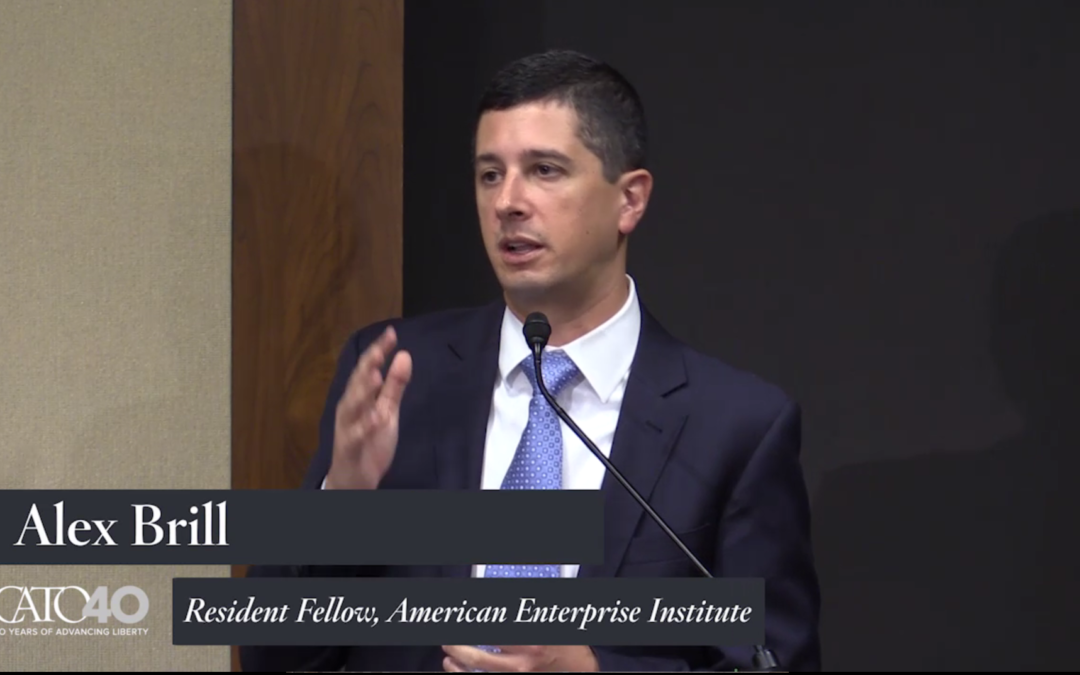

Alex Brill joined the Tax Foundation for a panel discussion on what the federal tax policy debate will look like over the next decade. He shared, “the idea that tax reform will need more work, saying that a sound policy must be sustainable and predictable. And he argued that Congress should consider new ways to broaden the tax base to afford more sound, pro-growth reforms.”

Mar 1, 2018 | Events

On Thursday morning at AEI, Senate Finance Committee Chairman Orrin Hatch (R-UT) gave remarks on the recently passed Tax Cuts and Jobs Act. He discussed the impact of the new tax plan and what it means for the American economy moving forward.

Nov 28, 2017 | Events

Following his remarks, Chairman Brady joined AEI’s Alex Brill for a discussion on the potential opportunities and impacts of tax reform. Mr. Brill asked Chairman Brady about the features of the Tax Cuts and Jobs Act and the ways in which the act would affect different individuals. Mr. Brill discussed the significance of the corporate tax rate cut and the change in standard deduction that tax reform would bring. Chairman Brady concluded by emphasizing the importance of moving to a simpler tax system.

Oct 26, 2017 | Events

While speaking as a panelist, Alex Brill says, “we can have a tax reform that is net positive for the overall economy. With a better system, one different from the system we have today, the size of the US economy will be larger than it otherwise would be. It will take time from the day of enactment to the day that that effect is fully realized. And during that period of time, the economy will grow faster and then it will reach this new higher level that it otherwise wouldn’t reach and we will all be better off as a result of that.”