Jan 23, 2018 | Op-Eds

Cigarettes are known killers, with nearly one in five deaths each year in the United States attributable to smoking. But there is a chance that U.S. smokers may soon be able to choose a less harmful alternative.

Jan 16, 2018 | Op-Eds

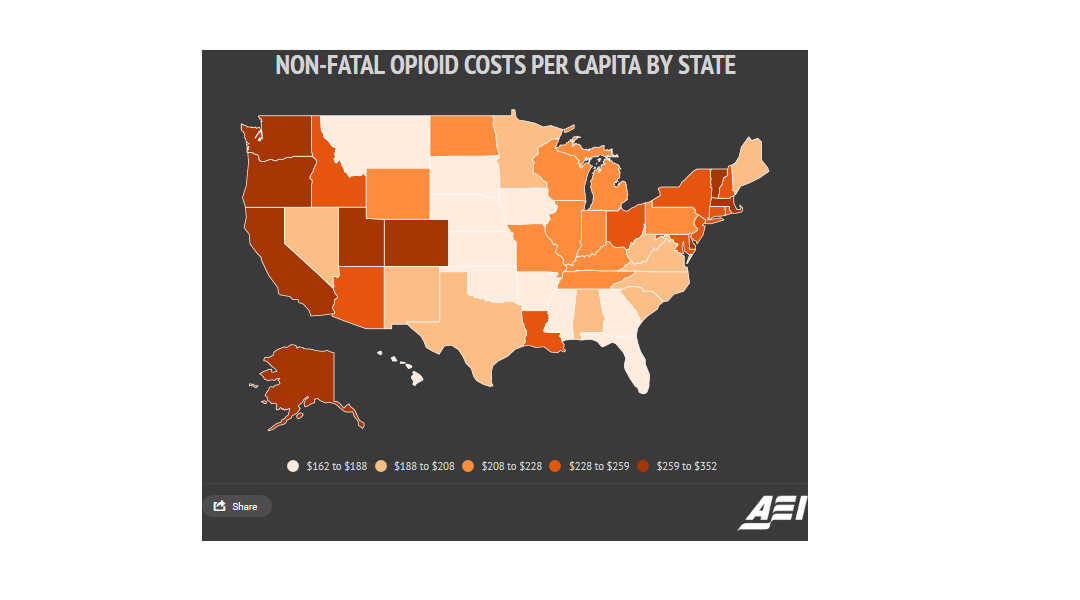

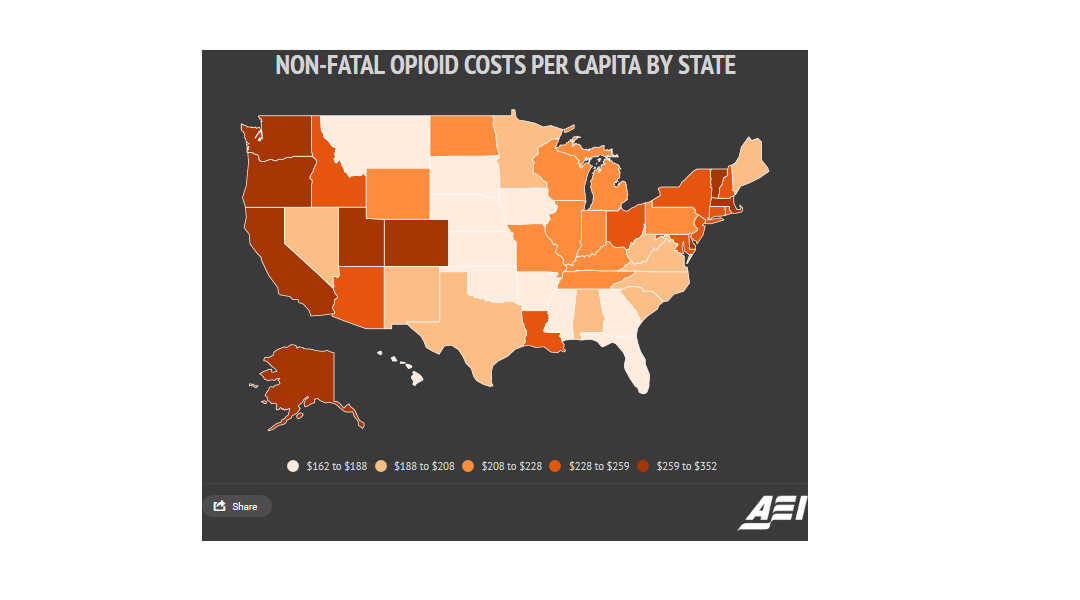

No one disputes that opioid abuse has caused an epidemic in our country, one that costs tens of billions, if not hundreds of billions, of dollars per year. Less well known, but of vital importance to policymakers, is how these costs are distributed. Opioid abuse rates and deaths vary considerably from state to state, as do the costs associated with this epidemic. But researchers have generally focused on the economic impact of the crisis in the aggregate, at the US level. In a new analysis, I estimate the cost at the state level and find substantial variation across the country. Here, I offer a preview of my findings, which will be released in full next month.

Dec 11, 2017 | Op-Eds

Lawmakers are on the verge of fundamentally updating the international provisions of the US tax code. Currently, we have a worldwide system, under which profits US firms earn abroad are subject to US tax minus a credit for foreign taxes paid and subject to a deferral until repatriation. In an effort that began in 2011 with draft legislation from former Ways and Means Chairman Dave Camp, Republicans have been determined to transform the US tax code into a territorial system, under which active income earned abroad is generally exempt from US tax.

Dec 1, 2017 | Op-Eds

Congress is deeply entrenched in an effort to reform the federal tax code. Central to this effort is a desire to lower the U.S. corporate tax rate from 35 percent to 20 percent — a level on par with the rest of the developed world. Policymakers are keenly aware of the competitive advantages this change could bring based on similar rate changes across Europe and around the globe.

Nov 28, 2017 | Op-Eds

Both the House’s tax bill and the Senate Finance Committee’s bill slash the corporate income tax rate from 35 to 20%, a much needed reform that will pull capital into the United States and grow the economy. Thankfully, both bills cut the corporate rate on a permanent basis.

Nov 21, 2017 | Op-Eds

I believe that the current US tax code imposes drag on US economic growth and alternatives to the current system could result in an increase in the capital stock, a boost in worker productivity, and thus an increase in wages. This positive economic result would occur slowly over time as new investment is deployed and workers adopt to new opportunities.