Navigating the Upcoming Tax Cliff: Can Republicans Prevent a Tax Increase Without Adding to the Deficit?

On December 22, 2017, President Donald Trump signed into law the Tax Cuts and Jobs Act (TCJA).

On December 22, 2017, President Donald Trump signed into law the Tax Cuts and Jobs Act (TCJA).

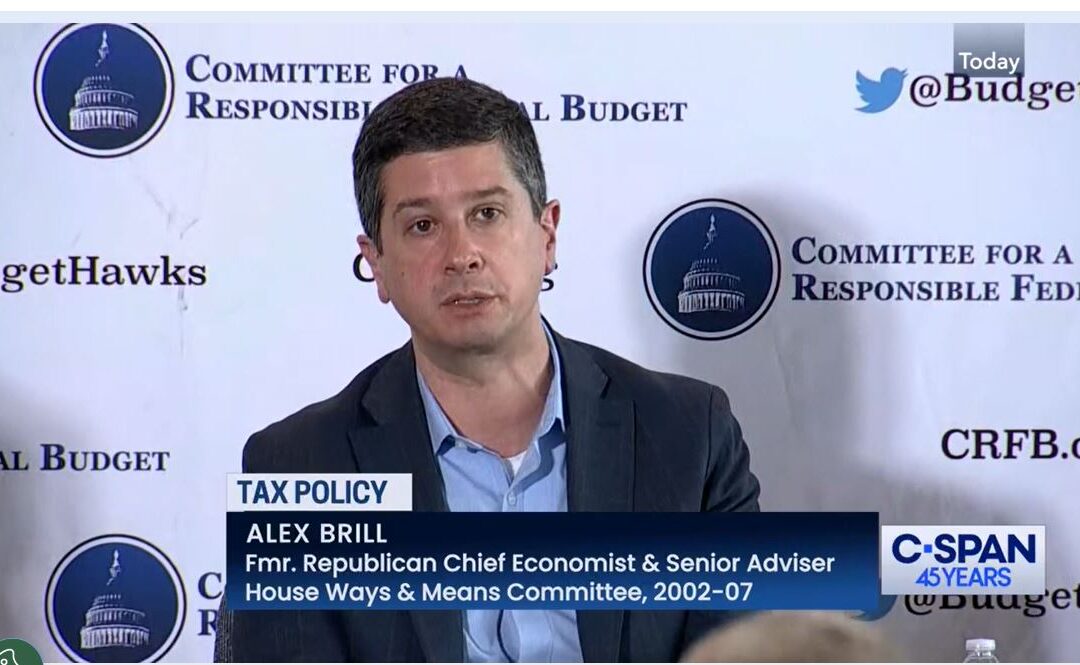

The Committee for a Responsible Federal Budget hosted “a tax policy summit “When the TCJA Expires: A Tax Policy Summit” on March 28, 2024.

If the Supreme Court rules in their favor, it could open the door to reshaping the country’s tax code.

This week, the Supreme Court will hear oral arguments in Moore v. United States, a case that centers on the mandatory repatriation tax (MRT).

We have submitted an amicus brief in support of the respondent (the US government) arguing that the MRT is constitutional as an indirect tax.